Sino-U.S. trade deal optimism lifts UK's FTSE; Ted Baker slips

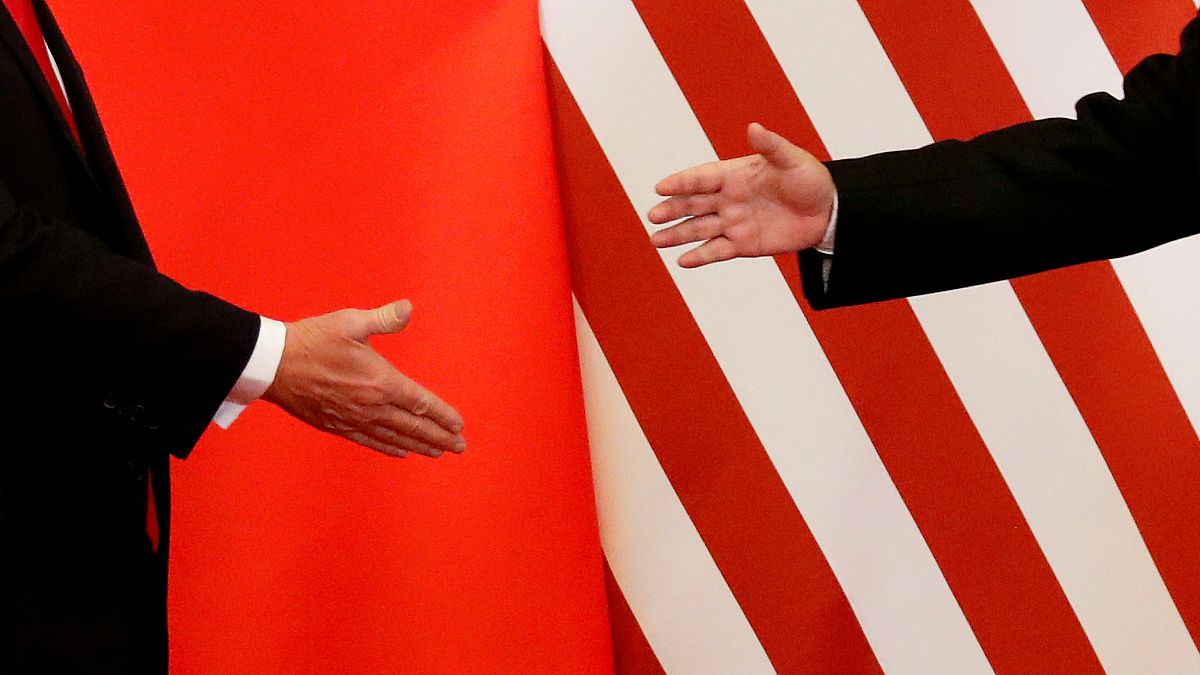

Britain's blue-chip index rose on Monday as miners and financial firms were boosted by reports that China and the United States were nearing a trade deal, while Ted Baker tumbled on founder Ray Kelvin's exit and a court ruling hit British American Tobacco.

The FTSE 100 nudged 0.3 percent higher by 0830 GMT while the UK-focused midcaps were up 0.2 percent.

Miners and financial stocks advanced on reports that Washington and Beijing were close to a trade deal to end a prolonged dispute that has hurt global economic growth.

That also helped industrial groups Ashtead and Melrose top the FTSE 100 leader-board.

But British American Tobacco skidded 2 percent after a Canadian court upheld most of a 2015 decision that awarded around C$15 billion (£8.5 billion) to smokers in Quebec.

Ted Baker slid 5 percent to join the top midcap losers after the fashion retailer's founder and chief executive officer Ray Kelvin quit following allegations of misconduct relating to his habit of hugging business colleagues.

"Ted Baker has grown steadily and has become a global brand and we do not see any change to the Group's long term prospects," wrote Liberum analysts, calling his departure unfortunate yet understandable

Daily Mail and General Trust advanced 4.6 percent to top the pan-regional STOXX 600 after plans to return all of its shares in Euromoney Institutional Investor and 200 million pounds in cash to eligible shareholders.

Syncona shares gained 4.5 percent on the midcap index after U.S. company Biogen agreed to buy Nightstar which is partly owned by the FTSE 250 constituent.

Industrial group Rotork slumped 7 percent after forecasting slower growth in 2019 on account of "macroeconomic uncertainty".