While most analysts feel optimistic about the euro area's economic situation for the next six months, many remain concerned about its current state.

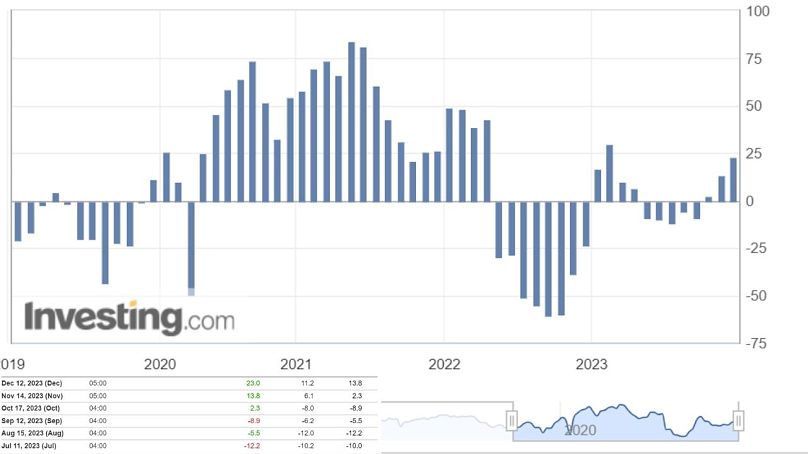

Economic sentiment in the eurozone for the next six months has surged to 23 in December, reaching its highest point in 10 months and surprising analysts.

The 9.2-point increase, as shown by the ZEW Indicator of Economic Sentiment for the Euro Area, exceeded market forecasts of a score of 11.2.

The survey considers the views of around 350 financial and economic analysts and assesses the difference between those who have a positive outlook on the economy for the next six months and those with a negative perspective.

The ZEW index measures economic confidence on a scale from -100 (representing expectations of a worsening economy) to 100 (representing feelings of improvement).

Among those surveyed in December, 37.6% of analysts expect an improvement in economic conditions, while 47.8% predict stability.

However, 14.6% remain cautious, foreseeing a possible economic decline, suggesting a cautious yet optimistic outlook for the euro area's economic situation in the next six months.

By contrast, the figures reflecting feelings of the current economic situation experienced a slight downturn, decreasing by 0.9 points to -62.7. They suggest that sentiments among analysts are divided between an optimistic future and uncertainty over the present challenges within the economic landscape.

Notably, inflation expectations surged by a substantial 14.5 points to -58.2, indicating concerns about rising inflationary pressures in the eurozone ahead of the European Central Bank's next interest rate announcement on Thursday. This uptick highlights analysts' growing concerns about inflation trends, potentially posing a challenge to the region's economic stability.

As 2023 draws to a close, analysts and stakeholders continue to monitor forecasts, using them to navigate the evolving financial landscape within the eurozone and shape decisions in the upcoming months.