To commemorate 25 years of the single currency in Europe, we ask students, workers and a former president of the European Central Bank for their perspectives on the past, present and future of the euro and the eurozone.

Twenty countries, one single currency: the euro is celebrating 25 years of existence, after weathering the storm of various crises and a global pandemic, and becoming one of the world's most important currencies.

This anniversary provides an opportunity to assess how the eurozone navigated these challenges and implemented reforms to ensure the stability of its currency, while also considering the achievements and perspectives ahead.

'A declaration of the existence of a united Europe'

So, why was the euro created in the first place, and how did the currency survive the numerous challenges it has faced?

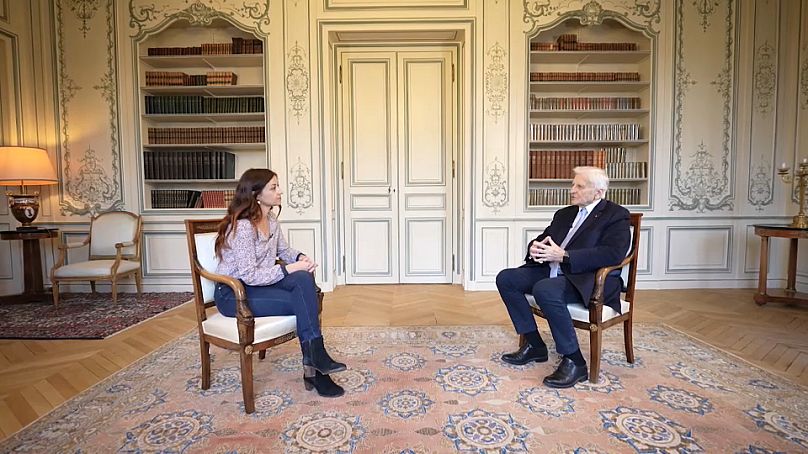

Real Economy spoke to the former President of the European Central Bank (ECB), Jean-Claude Trichet, about some of the milestones that have marked the history of the single currency.

"The creation of the euro is the need to have a real single market, a true single market," he explained.

"It was truly a major decision, but also a kind of assertion, a declaration of the existence of a united Europe. And, what we proved is that, indeed, Europeans were capable of creating a serious, strong currency. 79% of Europeans in the eurozone approve of the euro. For me, that's the most beautiful of rewards."

Reflecting on his time as President of the European Central Bank, Jean-Claude Trichet revealed that "two very intense periods" had left the most significant impression on him.

"The financial world was collapsing after the bankruptcy of Lehman Brothers, and it was necessary to make a multitude of extremely important decisions very quickly. It required considerable effort.

"Then there was the period of May 2010, which marked the true beginning of the sovereign debt crisis in Europe. Five European countries in total, during my time, were placed in a very difficult situation. And this required, I believe, extraordinarily courageous decisions from the countries involved to overcome the crisis, from their governments, and of course, from the European Central Bank, which, in all these matters, was on the front line."

Looking ahead to what the future might hold for the single currency, Jean-Claude Trichet said he was "convinced that the path toward a European confederation, a true European confederation, with even more unity on the budgetary and economic fronts, as well as genuine unity in defence, security, and diplomacy, is a long-term necessity."

Following these crises, the Eurogroup created the European Stability Mechanism to assist member countries facing economic difficulties.

In the countries that adopted it, the euro has changed people's daily lives, making travel, purchases, or studying abroad more accessible.

How do young Europeans perceive the euro?

We met with a group of economics students at the University of Nanterre, to the west of Paris, to find out how those born in the euro era perceive the currency.

"Growing up with it, I found that it was mainly an advantage to have a stable and strong currency," explained Thomas.

"If there are two challenges, in my opinion, that need to be addressed by the euro, it's the digital euro, and particularly the implementation of accommodative monetary policies for investment in green projects," he added.

"There is also a question about the future of the European Central Bank and the policies it will implement. They could be more egalitarian," said fellow student, Benjamin.

According to the Eurobarometer, 79% of Europeans living in the eurozone approve of the single currency for Europe as a whole, while 69% approve of it for their own country.

Among the most satisfied are Finland, Ireland, and Germany; the least satisfied include Croatia, Cyprus, and Italy.

Mixed opinions of the single currency in Italy

Our final trip is to the Italian capital of Rome, where opinions on the European currency are mixed.

"It brought a huge increase in all the prices of the products I sell," said one woman who spoke to Real Economy.

"It was better with the lira because there was monetary sovereignty," another man explained.

To find out whether there are, in fact, winners and losers among the members of the eurozone, we met Giovanni Farese, an Associate Professor of Economic History at the European University of Rome.

"Monetary policy is never neutral," he told Real Economy.

"In Italy, for example, economic growth has been disappointing for many of us for the past 25 or 30 years. But of course, monetary policy is one part of economic policy. What is needed is to strengthen other aspects and dimensions of economic policy. But of course, if you have one single monetary policy without having one single fiscal policy, you miss a leg. And so the process is incomplete."

How can the eurozone better prepare for future economic challenges?

Reforms such as a unified fiscal policy could enable the eurozone to better absorb economic shocks.

Since the start of the war in Ukraine, the annual inflation rate in the eurozone peaked at 10.6% in October 2022. It then fell to 2.4% in November 2023.

The average annual inflation since the creation of the euro, on the other hand, is 1.95%.

The ECB, whose mission is financial stability and keeping annual inflation below 2%, will maintain its commitment in this direction, assures Piero Cipollone, a Member of the ECB's Executive Board.

"The Eurosystem has been able to react over the years to changing circumstances. Let's all remember Mario Draghi's 'whatever it takes' that changed and stabilised the market. So, the important thing is to be ready to understand reality, to understand how to adapt, to be ready to adapt.

"The economy changes, society changes, technology changes, people's habits change, and electronic payments are increasingly becoming an everyday reality. So, the Eurosistema must prepare for this. And it is doing so by thinking about the banknote of the future, a digital banknote. The digital euro."

The digital euro will open a new chapter in the history of the European currency.